Insurance and Bonds for Contractors

Contractors Insurance

Offenhauser is a full-service insurance and bond agency/broker with a specialization in insurance and bonds for contractors. We offer a full array of traditional insurance and performance and payment bonds, but also larger risk management programs such as captive and group captive insurance programs, project specific wraps for the contractor (CCIP), sub-contractor default insurance and project specific builders risk insurance. We insure contractors of all sizes and experience.

We assess risk from construction sites, contracts, claims and financials, then work with the client to mitigate it. Whether it’s advocating on a serious claim matter, reviewing indemnity and insurance language in a construction contract, assessing the costs of a construction delay, assisting with development of a new safety program or designing project specific insurance, we stand with our clients, like we’ve been doing for more than a century.

Two outstanding successes:

- Obtained $4.7MM in bonding for a contractor who never needed a bond for more than $1MM previously.

- Wrote project specific professional liability for a design build high-tech agri project, saving more than $300,000 over separate coverage from the five company design build team.

Below are brief discussions of important risk topics to contractors. Contact a member of the team to start a conversation about your project.

Contact

Rani Gauriar, CRIS, ACSR

Licensed Account Representative

"Email me" <rgauriar [at] fwoins [dot] com>

Construction, even each project has different risks.

We listen and assess. With more than a century of experience and people with backgrounds in disciplines related to construction, we assess risk by asking questions, reviewing contracts and . Maybe your company renovates which represents a large care custody and control exposure, normally excluded on builders risk and commercial general liability policies or needs a written safety program in Spanish or recommendations for reducing it’s workers compensation experience modification rating below 1.

We design insurance that fits the assessment and appetite of the client. We work with some of the finest insurance companies in the US to design a customized program, procuring multiple quotes and determining with the client the the best value for their construction company.

We execute. More than service, our job starts day one with a new client. From review of indemnity agreements and insurance requirements of contracts to claims advocacy, we are there for our clients. That’s why many clients have been with us for decades.

If your construction company’s combined worker’s compensation, general liability and auto premiums approaches $250,000 annually with good loss experience, a group captive may should be considered. There are several specifically for commercial construction risks. Joining a group captive can provide long term benefits, but there are drawbacks.

Simply put, in a group captive, members own and control the program. The group has pooled their risks and maximized the purchasing power of a large group to reduce fixed costs for all. Often the group captive is “fronted” by a major insurer with an A M Best rating of A.

Common elements

Risk Sharing – Group captives share risks between members. Prospective members should understand the amount of risk being shared on an individual basis as well as the risks retained on a group basis.

Assessments – The captive may assess for underperformance (too many claims). It’s critical to understand the potential – from a member’s own loss experience and from other members’ adverse experience.

Ultimate Cost – Cost components are unbundled, but aren’t completely known upfront. It’s important to understand all costs - tail fund for commuting older policy years, bankruptcy of a member and members’ assessments – for example.

Collateral – Members are usually required to post security at approximately 140% of estimated ultimate losses. In a traditional loss sensitive insurance program, policyholders post security at approximately 100% of estimated ultimate losses. There is no security for guaranteed costs programs that offer dividends. This higher security requirement will continue for several years, thus making the payback 5 years.

Exit – Exiting a group captive is complicated. The group captive should articulate the process while the client considers, including how open claims, loss development, timing, assessments and buy-out penalties work.

We make sure the experience modifier is correct.

Many experience modifier ratings (EMR) promulgated by the National Council of Compensation Insurers (NCCI) are incorrect because of incorrectly classified or missing payroll or a downward change of reserves just before the insurance company reports claims data to the NCCI (6 months prior to your insurance anniversary).

A more common error is insurance companies failing to reduce reserves as claims mature.

We review claims and payroll data to make sure the calculation is accurate. If necessary, we conduct claim reviews to verify reserves are appropriate. We make sure payroll is correctly classified. This work is ideally performed 7 months prior to the insurance anniversary to insure accuracy of the EMR on the anniversary.

We help improve your company’s loss experience.

We choose from many value added services that best fit the client’s needs

A licensed claims department to monitor, advocate and help manage the claim

A library of safety information, including 24 industry specific bi-lingual safety manuals, such as construction, self inspection check lists, payroll stuffers, etc.

An attorney

Contract review

On-line and live HR help through Think HR

We evaluate workers compensation alternatives

Dividend plans, loss sensitive plans, group captives specific to construction and non-subscription programs are four alternatives to traditional guarantee cost plans.

Contractor’s Professional and Pollution Liability policies offers a cost-effective solution for firms with low risks of professional and environmental liability such as construction managers, design-builders, general contractors, street and road and civil contractors. An example of a large claim paid under one of these policies in our agency is when a general contractor incorrectly tore down a grandfathered billboard in a high traffic area.

Where pollution exposures are greater such as project with a brownfield site, a Pollution Legal Liability (PLL) is a an environmental policy for owning, developing or operating a facility or site. PLL provides environmental coverage for losses due to on-site or off-site pollution, coverage for pollution conditions resulting from transportation and coverage for owned or non-owned disposal site-related environmental liabilities.

Where professional exposures are greater such when there are licensed professionals on staff is a stand alone professional liability policy may be the most effective insurance coverage.

With architects and engineers often carrying low limits, a Project Specific Protective Professional Indemnity policy may be used to provide owners of a specific project with design efficiencies, higher and less expensive limits of coverage rather than each professional on the design team providing separate limits. It is similar to a CCIP or OCIP

1. Money – Depending on the type of construction and occupancy, a $25 MM+ project or greater may realize a substantial savings over traditional liability insurance. Projects $150 MM+, depending on type of construction and occupancy, may realize an additional savings by including workers compensation.

2. Coverage – Usually broad terms with dedicated per project limits through the statute of repose, allows for known cost

3. Control of Subcontractors - GM/CM negotiate the terms, limits, is responsible for administration and contractual risk transfer including passing costs of deductibles to subs. The process becomes standardized rather than negotiated with each sub and contract.

4. Convenience – Particularly with Rolling CIPs, certain administrative tasks may be “one and done” for the life of the contract.

5. Provide Named Insured Status to Owner – Allows GC/CM and owner’s interest to be aligned

6. Ability to Include Any Subcontractor - This could be important to include a new or disadvantaged contractor when needed coverage is not otherwise available

7. Safety On The Jobsite – One plan of safety instead of many.

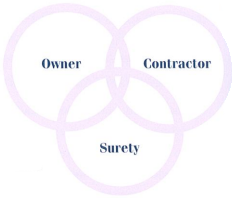

Contractor Performance and Payment bonds stand behind the contractor’s promise to:

Perform the work according to the contract’s terms and conditions and pay subcontractors, laborers and material suppliers.

We negotiate Bid, Performance & Payment Bonds for contractors from “First Bond” to $100 MM or more.

Contract bonding is a three party contract among the owner, contractor, and surety.